Employers must complete Form I-9 to verify the identity and employment authorization of new employees, both U.S. citizens and non-citizens. Employees complete Section 1 and employers complete Sections 2 and 3. This video shows how employers fill out Section 3when using a computer to complete a Form I-9obtained from the USCIS website. First, employers must ensure that employees have access to the form, instructions, and Lists of Acceptable Documents. Employers must either pr employees with printed copies or ensure employees have access to them online. Anyone can access the instructions from the Form I-9 web page. When connected to the Internet, you can access these instructions directly from the Form I-9by clicking the instructions button at the top of each page. Even without Internet access, employers and employees using a computer can move the cursor over fields or click on the question marks to see instructions. Lamp;#39’s see how employers or their authorized representatives must complete Section 3. When an employee'’s employment authorization or certain documentation expires, employers must reverify that the employees still authorized to work using Section 3. Employers can also complete this section when rehiring previous employees. When the employer enters the employee'’s name at the top of Section 3,the Employee Name fields in Section 2are automatically completed. If the employee'’s name changed since the last verification or re-verification, the employer should enter the employee'’s new name in Block A. If the employee'’s name has not changed, enter quot;N/Pequot; in all three spaces. If the employee was rehired within three years of original completion of Form I-9,the employer should enter the date of rehire in Block B. If not, enter quot;N/A.quot; If the employee'’s employment authorization has expired, the employee must present new documentation. The employer must review the documentation and determine whether it is acceptable for Form I-9. If acceptable, the employer must enter the document information in Block C. Once the employer or authorized...

Award-winning PDF software

How to prepare Form I-9 2025 Printable

About Form I-9 2025 Printable

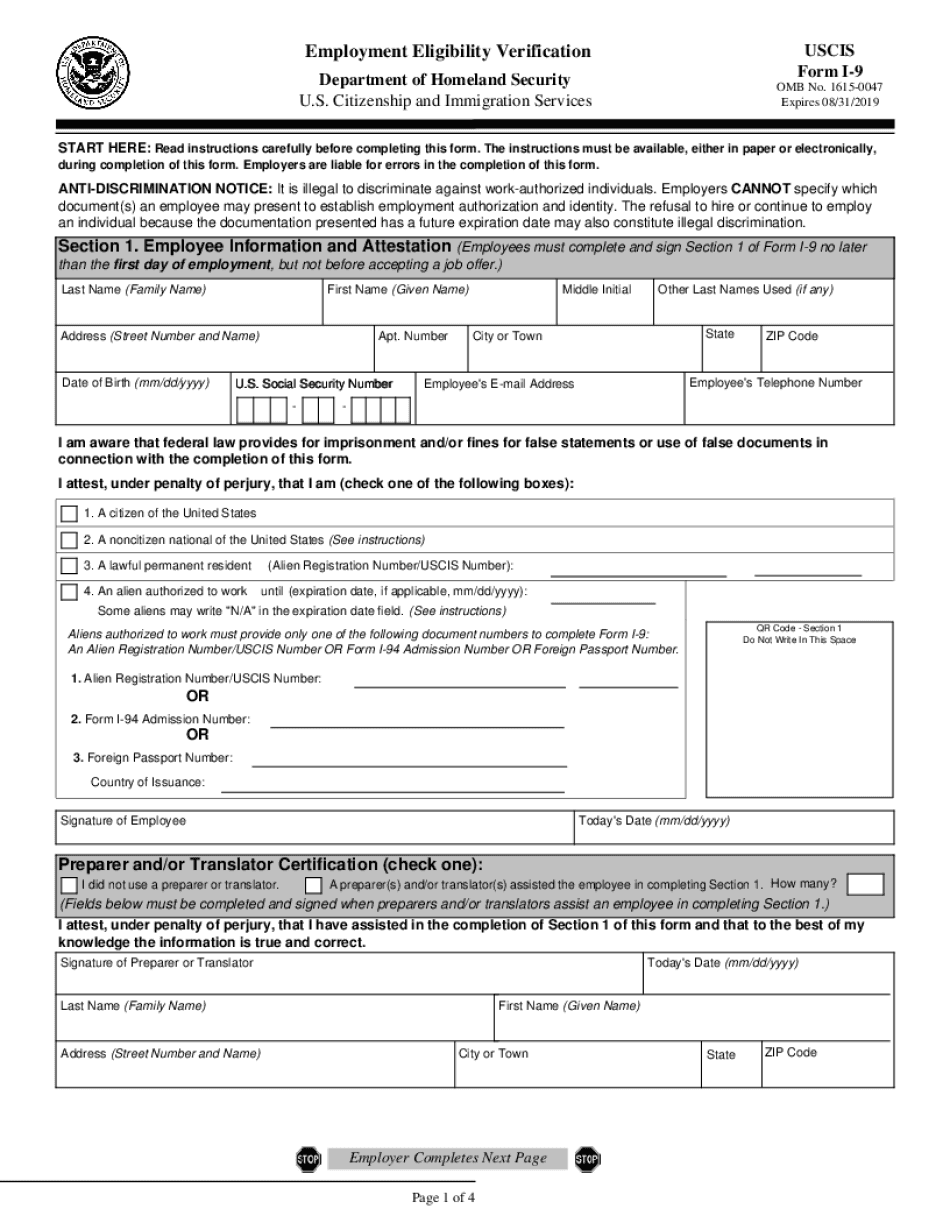

Form I-9 2025 Printable is a document used by employers to verify the identity and employment eligibility of their employees hired in the United States. All employers, including small businesses, are required by law to complete and retain a Form I-9 for each employee hired. New employees must complete Section 1 of the form no later than their first day of work, and employers must complete Section 2 no later than the employee's third day of work. The form includes various fields for personal information, such as full legal name, address, date of birth, and social security number. Additionally, the form requires identification documents to be presented and verified by the employer. Some examples of acceptable identification documents include a U.S. passport, driver's license, and birth certificate. By completing a Form I-9, employers help ensure that they are hiring individuals who are authorized to work in the U.S. and avoid potential fines and penalties for noncompliance.

What Is I-9 Form 2025 Printable

Form is used for verifying the identity of a new employee. By completing it, an applicant verifies that the documents he or she provided are authentic. Every hirer in the U.S. has to make sure that the I-9 or Employment Eligibility Verification form is completed properly by each individual they hire. The form has to be completed and signed by both sides, i.e. the employee and the employer. In some cases, employers can be substituted by their authorized representatives.

First, the applicant passes all the necessary identity confirmation papers, along with papers that establish employment authorization, to the hirer. After this, he or she checks whether the papers provided are authentic and fills out Pages 2 and 3 of the I-9.

It is important to note that federal law imposes penalties for any false data in connection with the completion of this form. It is also illegal to refuse to hire or continue to employ an individual because the some of the documents have a future expiration date.

Use the guidelines below to meet deadlines, avoid fines, and complete the I-9 2025 printable online in a few simple steps!

How do I fill out Form I-9 online?

The document consists of three sections:

- Employee information and attestation (filled out by an applicant)

- Employer or authorized representative review and verification (filled out by an employer)

- Reverification and rehires (filled out by an employer)

Employees must fill out Section 1 on the first business day of their employment. Section 2 must be completed by the hirer no later than three business days after the employee begins to work.

Employers must record in Section 2:

- Document title

- Issuing authority

- Document number

- Expiration date (if any)

- The date employment begins

Section 3 is filled out by the employer in case he or she rehires the employee within three years of the date of initial execution of the I-9.

Make sure all the necessary fields are completed. Be aware of grammar mistakes and typos. Look through the instructions and click the help button if you have trouble filling out your document. After you are finished, you can save it in PDF format to your hard drive.

Process your USCIS I-9 electronically and forget about submitting paper copies. Click the ‘Start Now’ button or the template preview on the right to start editing your printable document online. You can do it from any desktop or mobile device connected to the Internet. No additional software has to be downloaded and installed!

Online remedies help you to prepare your document management and raise the efficiency of your respective workflow. Stick to the short manual to finished Form I-9 2025 Printable, prevent glitches and furnish it inside a well timed fashion:

How to accomplish a Form I-9 2025 Printable on the internet:

- On the website using the type, simply click Commence Now and go on the editor.

- Use the clues to fill out the relevant fields.

- Include your own data and make contact with data.

- Make guaranteed which you enter accurate material and numbers in ideal fields.

- Carefully examine the subject matter belonging to the form in the process as grammar and spelling.

- Refer to aid segment for people with any concerns or address our Assist team.

- Put an digital signature on your Form I-9 2025 Printable along with the enable of Sign Device.

- Once the shape is accomplished, press Completed.

- Distribute the completely ready form by means of e-mail or fax, print it out or preserve in your equipment.

PDF editor lets you to make improvements on your Form I-9 2025 Printable from any online world related machine, customize it in line with your preferences, signal it electronically and distribute in different techniques.

What people say about us

Take full advantage of a professional form-filler

Video instructions and help with filling out and completing Form I-9 2025 Printable